未来资本聚焦的五大方向:

1. 人工智能:繁荣还是泡沫?

2. 医疗行业的颠覆性变革

3. 自动化与机器人技术

4. 构建能源基础设施

5. 重新定义国防安全

AI: Boom or bust?

Yes, U.S. big tech companies have opened the spigot for AI spending, but these are still early days. We think capital investment in AI could take off in the coming years, driven by rapid improvements in AI models and corporate adoption. Consider: AI could potentially impact all services activity in the economy.

Why are we so optimistic? First, because AI models are improving at a rapid rate. In 2021, large language models (LLMs, a type of AI) could answer less than 10% of competition-level math questions accurately. That share increased to 90% in 2024. The models are also becoming less expensive: The price per token for both OpenAI’s higher-performing GPT-4o mini model and Anthropic’s Claude 3.5 Haiku model are 90%–98% less expensive than their predecessors.

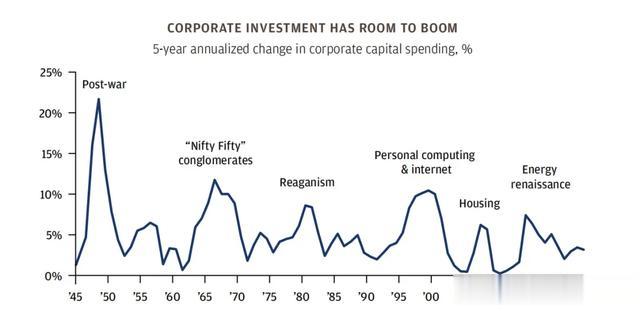

Second, overall corporate capital investment has been relatively muted, running at a 2.5% annual pace. By contrast, at the end of the dot com boom at the turn of the millennium, corporate capex was running at a 10% annual pace (on a five-year rolling basis). In other words, there is plenty of room for corporations across sectors to increase their AI spending as the use cases become more apparent—and persuasive.

Third, we see the potential for AI to “turn labor into software,” as Sequoia Capital has put it. As models improve their ability to reason instead of merely generating pre-trained responses, they will help create opportunities to disrupt the services sector. AI lawyers, AI software engineers and—dare we say it?—AI investment strategists could become commonplace. Public markets and their private partners have established a strong presence in the digital infrastructure of AI. The industrial and utilities companies that provide the physical components and energy needed for AI will also likely continue to benefit. Finally, the companies that most effectively improve their cost structures and increase productivity by incorporating AI tools into their workstreams should outperform.

In private markets, pure-play AI valuations have inflated, but we still see investment opportunities in the startups that can automate tasks and provide cost savings to businesses. Value may also be created in the potential applications that can help harness the technology for consumers. Over 20 major application layer companies (e.g., Salesforce, Meta, Uber) were founded during the cloud and mobile transitions. AI could create a similar ecosystem.

Adoption of AI could falter, of course. Regulation could stifle innovation. Energy sourcing could prove onerous. And the models could run out of the data they use to train. But our analysis—looking past the hype and drawing on the lessons of history—tells us that AI offers significant investment opportunity. We see the potential for a clear bull case for the global economy and equity markets next year and beyond.

一、人工智能:繁荣还是泡沫?

美国的大型科技公司已经打开了AI投资的大门,但目前仍是早期阶段。我们相信,随着AI模型的快速进步和企业逐渐接受,未来几年AI资本投资将迎来爆发式增长。试想一下,AI可能会深刻影响经济中的每一个服务领域。

为什么我们对AI如此乐观?

1、AI模型的性能在不断突破。还记得2021年时,大型语言模型(LLMs)能准确回答的竞赛级数学题不到10%,但到了2024年,这一比例已经飙升到90%。更重要的是,使用这些模型的成本也在迅速下降。以OpenAI的GPT-4o Mini和Anthropic的Claude 3.5 Haiku为例,每个Token的价格比上一代产品便宜了90%-98%。

其次,企业的整体资本支出目前增长缓慢,年均增长仅为2.5%。相比之下,在互联网泡沫高峰期,企业资本支出年增长率曾高达10%。这意味着,随着AI的实际应用越来越清晰,各行业的企业在AI领域还有很大的投资潜力。

2、AI可能带来一次“劳动变革”。红杉资本一份调查显示:AI有潜力将“劳动变成软件”。随着AI模型从简单的预训练响应转向更强的推理能力,服务行业将迎来新的颠覆机会。未来,AI律师、AI软件工程师,甚至AI投资策略师都有可能成为我们日常工作的一部分。

AI的发展不仅依赖数字基础设施,那些为AI提供物理设备和能源的工业公司和公用事业公司同样将受益。而那些能够利用AI工具优化成本结构、提升生产效率的企业,将更具竞争优势。

在私人市场中,虽然纯AI业务的估值已经偏高,但那些能够实现任务自动化、帮助企业节省成本的初创公司仍然值得关注。同时AI的潜在应用也蕴藏机会,比如为消费者开发实际用途的技术。在过去,云计算和移动互联网的转型催生了像Salesforce、Meta、Uber这样的巨头。我们相信,AI将创造出类似的生态系统。

当然AI的普及也面临一些风险,比如监管可能限制创新、能源问题可能变成负担,甚至AI模型可能耗尽可用的训练数据。但从历史经验和实际分析来看,AI带来的投资机会是巨大的。我们相信,未来几年,AI不仅能推动全球经济增长,还将为股市注入强劲动力。

Healthcare Disruption

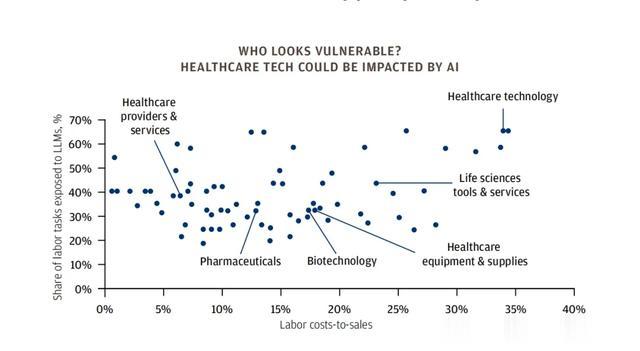

AI may quickly impact the healthcare sector. The chart helps to understand why. The industries that could be most impacted by AI have a high share of labor costs in jobs that could be helped or displaced by LLMs. For example, the healthcare technology industry has labor costs equivalent to around 35% of its sales.

At the same time, economists estimate that 65% of the tasks performed by healthcare technology employees are exposed to AI disruption. For example, companies such as Veeva Systems, Teladoc and GoodRx that provide software solutions across the healthcare value chain could both reduce their labor costs and increase their revenues by incorporating AI into their businesses.

In the pharmaceutical and biotech sectors, AI could also potentially improve the quality and quantity of drugs that progress from early-stage trials to market. Right now, only 7% of new drugs make it to market. Just a 5% increase in that success rate could mean 60 new drugs and USD 70 billion in incremental revenue over a 10-year period. In life science services, companies could use AI to design drug trials more optimally: from compound identification to participant selection.

We also believe GLP-1 drugs will continue to drive revenue growth (glucagon-like peptide drugs control blood sugar and suppress appetite). According to our estimates, we think the total addressable market could grow from 16 million people in the United States and the European Union in 2027 to over 40 million people. Beyond GLP-1s, we are focused on identifying companies in the healthcare sector that can use AI to modernize their business models to drive earnings growth. The clearest examples right now are in robotic surgery and imaging technologies used for diagnostics.

二、医疗行业的颠覆性变革

人工智能(AI)正快速改变医疗行业,这背后的逻辑其实很简单:一些劳动成本占比较高的岗位,很多任务都可以被AI优化甚至取代。拿医疗技术领域来说,劳动成本占销售额的35%左右,而专家预测,这些岗位中有65%的工作任务都可能受到AI的颠覆性影响。

比如像Veeva Systems、Teladoc和GoodRx这样的公司,它们为医疗行业提供软件解决方案。如果引入AI,不仅能降低人工成本,还能提升收入。还有制药和生物技术领域,AI的加入或许能大幅提高药物研发的效率和成功率。目前,新药从早期试验到上市的成功率只有7%。如果这一比例能提升5%,未来10年可能新增60种药物,带来高达700亿美元的额外收入。此外,生命科学服务领域也可以通过AI优化药物试验流程,从化合物筛选到试验参与者,选择都更科学、更高效。

我们还特别看好GLP-1类药物(胰高血糖素样肽药物),它们不仅能控制血糖,还能抑制食欲。据我们估算,到2027年,这类药物的潜在市场规模将在美国和欧盟从1600万人扩大到超过4000万人。

除了GLP-1药物,那些能利用AI升级商业模式的医疗公司同样值得关注。目前最典型的例子包括机器人手术和用于诊断的成像技术,这些方向正在快速驱动行业的盈利增长。

Automation & Robotics

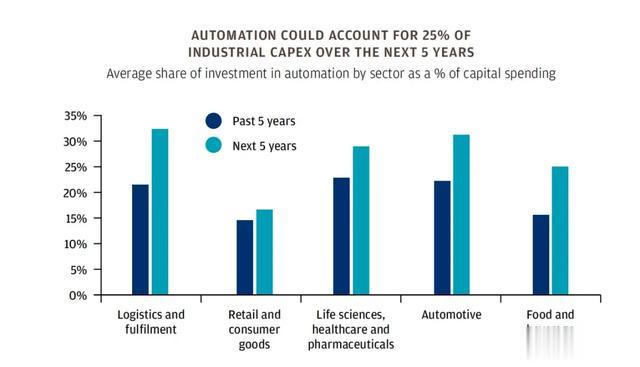

Capital investment in AI will also fast-track the adoption of automation and robotics, impacting industrial and consumer sectors. U.S. industrial companies are set to allocate 25%–30% of their capital spending to automation over the next five years, up from 15% to 20% over the last five years.

This theme isn’t new. Single-purpose robots have existed for over half a century, and robotics returns for investors have been modest so far. But we think momentum is building for broader applications. As access to training data increases and the cost of hardware declines, general-purpose robots may be closer to achieving the ability to reason. Globally, companies have invested over USD 4 billion in funding more than 20 “humanoid” robots.

Eventually, robots (humanoid and otherwise) may become a part of our daily lives. Waymo is already providing more than 100,000 autonomous taxi rides per week.

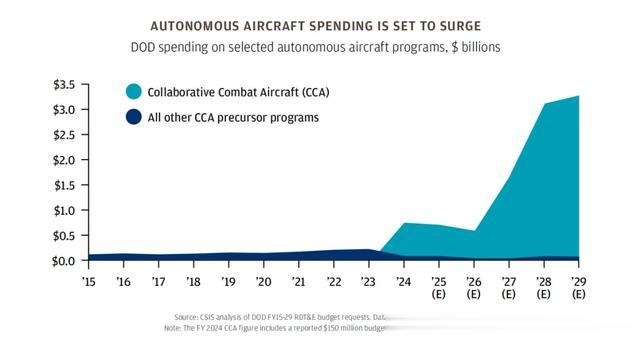

Healthcare and defense are two other areas where robotics will become more prevalent. In October, Intuitive Surgical delivered 110 of its semi-autonomous, AI-enabled Da Vinci 5 robotic surgery systems, trouncing the 70 placements from the previous quarter. Earlier in the year, the U.S. Air Force announced a contract award with Anduril and General Atomics to develop Autonomous Collaborative Combat Aircraft. The Department of Defense expects to spend nearly USD 3 billion per year on the program by 2029.

We see investment opportunities in both public and private markets, in the semiconductor companies that provide the computing power, the software companies that harness that computing power, the industrial companies that capitalize on higher efficiency, and the consumer companies that can deliver a game-changing product.

AUTONOMOUS AIRCRAFT SPENDING IS SET TO SURGE

AUTOMATION COULD ACCOUNT FOR 25% OF INDUSTRIAL CAPEX OVER THE NEXT 5 YEARS

三、自动化与机器人技术的崛起

人工智能(AI)的资本投入正在加速自动化和机器人技术的普及,影响到工业和消费领域。预计未来五年,美国工业企业将把25%-30%的资本支出用于自动化,相比过去五年的15%-20%有明显提升。

其实,这个主题并不新鲜。单一用途的机器人已经存在了半个多世纪,但过去的投资回报并不算突出。不过,随着训练数据的获取越来越便捷,硬件成本逐步下降,机器人应用正向更广泛的领域迈进。特别是通用型机器人,距离实现“推理”能力似乎越来越近。全球范围内,企业已投入超过40亿美元,用于支持20多个“类人型”机器人项目。

未来无论是类人型机器人还是其他形式的机器人,都可能逐渐融入我们的日常生活。比如Waymo目前每周已经提供超过10万次自动驾驶出租车服务。

在医疗和国防领域,机器人技术的应用也在快速增加。今年10月,Intuitive Surgical公司交付了110套配备人工智能的Da Vinci 5机器人手术系统,这一数字远超上一季度的70套。而在今年早些时候,美国空军还与Anduril和通用原子公司签署了一项开发自主协作战斗机(Autonomous Collaborative Combat Aircraft)的合同。美国国防部预计,到2029年,该项目的年度预算将接近30亿美元。

我们认为,投资机会不仅仅存在于机器人本身,还包括其相关的上下游产业。比如提供计算能力的半导体公司、开发软件以充分利用计算能力的科技企业、通过自动化提升效率的工业企业,以及能将机器人技术转化为消费级颠覆性产品的公司,都是值得关注的领域。

图:无人机领域支出有望大幅增长

图:未来五年,自动化可能占工业资本支出的25%

Building Power Infrastructure

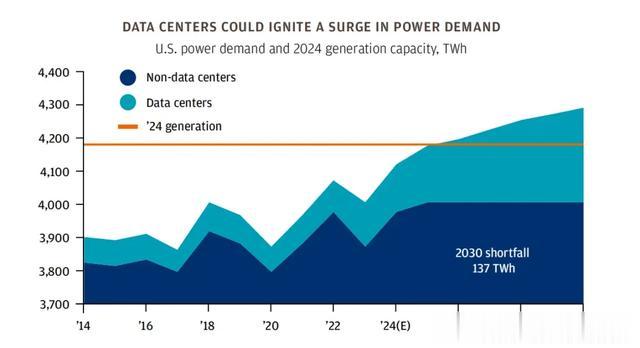

We think capital investment into the power sector is about to ignite for three key reasons: the reindustrialization of U.S. manufacturing, increased use of electrification in clean energy solutions, and surging demand from data centers. Overall, we expect power demand growth in the United States to increase by 5x to 7x over the next 3–5 years.

Data center growth is a global phenomenon. The number of U.S. data centers, accounting for 40% of the global market, is growing ~25% per year. In Q1 2024, the European, Latin American, and Asia-Pacific data center markets grew inventory by 20%, 15%, and 22% year-over-year, respectively. Increased data center power requires more water for cooling and chip fabrication, often in water-stressed areas. Global data centers are expected to grow their water usage by 6% annually. Large semiconductor fabrication facilities use the same amount of water as 300,000 households. We see opportunities for water infrastructure and efficiency solutions in parallel with growing power usage.

More power will likely come from nuclear energy. We note the equity market’s validation of Constellation Energy’s and Microsoft’s agreement to restart the Three Mile Island nuclear power plant to supply energy to the tech giant’s data centers. This should spur further reinvestment in nuclear energy. Indeed, the surge in the Nuclear Renaissance Index (+75% year to date) is based on market speculation that small modular reactors will be successfully deployed in the next few years. While renewable energy sources will continue to grow (the International Energy Agency believes that for every $1 invested in fossil fuels, $2 are invested in clean energy), latency, transmission, and storage costs mean that natural gas will remain a critical energy source.

Investors looking to capitalize on the growing demand for power can focus on broad infrastructure funds, power generation, and utility companies.

THE MARKET HAS VALIDATED NUCLEAR EXPANSION

DATA CENTERS COULD IGNITE A SURGE IN POWER DEMAND

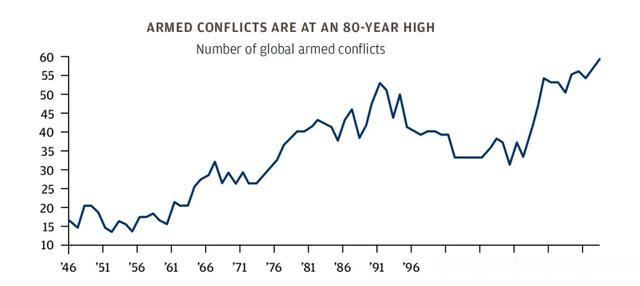

ARMED CONFLICTS ARE AT AN 80-YEAR HIGH

四、构建电力基础设施

我们认为,电力领域的资本投资即将迎来快速增长,背后有三个关键原因:

1、美国制造业的再工业化

2、清洁能源解决方案中电气化的广泛应用

3、数据中心对电力需求的激增。

总体来看,预计未来3-5年,美国的电力需求增长可能达到5倍至7倍。

数据中心的增长是全球现象。目前,美国的数据中心数量约占全球市场的40%,每年以约25%的速度增长。2024年第一季度,欧洲、拉丁美洲和亚太地区的数据中心库存同比分别增长了20%、15%和22%。数据中心对电力的高需求还伴随着对水资源的更大需求,主要用于冷却和芯片制造,尤其是在水资源紧张的地区。预计全球数据中心的用水量每年将增长6%。一座大型半导体制造厂的用水量相当于30万个家庭的用水需求。这种趋势为水利基础设施和水资源效率解决方案带来了投资机会。

核能可能成为提供更多电力的重要来源。市场已经认可了Constellation Energy与微软的合作协议,他们计划重启三里岛核电站,为微软的数据中心供电。这一合作有望进一步推动核能的再投资。事实上,“核能复兴指数”今年已上涨75%,这主要源于市场对小型模块化反应堆(SMR)在未来几年内成功部署的乐观预期。

虽然可再生能源将继续快速发展(国际能源署数据显示,每1美元的化石燃料投资就有2美元投入清洁能源),但由于延迟性、传输及存储成本问题,天然气仍将是重要的能源来源。

对于希望抓住电力需求增长机遇的投资者,可以关注广泛的基础设施基金、电力生产公司以及公用事业企业。

图:市场已认可核能扩展

图:数据中心或将引爆电力需求的激增

Redefining Security

As governments reassess their national security, they will likely deliver higher levels of capital investment. Security covers not just traditional military defense, but cybersecurity, supply of critical natural resources, energy production, transportation, and infrastructure. We think markets do not yet fully appreciate the investment prospects that this secular shift will create.

In the United States, the government seems likely to continue incentivizing domestic production of critical supplies. Shares in a North Carolina–based chipmaker surged 40% on the news that it secured USD 750 million in CHIPs Act funding to build two new semiconductor plants in the United States. Further, we highlight a U.S. government goal to diversify its reliance on concentrated aerospace and defense specialists (which today account for 90% of the U.S. weapons production budget),

and expand to established commercial companies and startups with expertise in areas such as AI, machine learning, and 5G technology. The defense market could potentially generate revenues and market share for companies outside the traditional defense space. The Department of Defense budget has halved as a share of GDP from the height of the Cold War. Of the European Union members of NATO, 16 of the 23 are currently on track to surpass the targeted 2% of GDP threshold in 2024. Ten years ago, the average member was only at 1.2% of GDP. Global military spending seems to have room to grow, especially in areas such as network-enabled weapons, which could be human-machine partnerships or fully autonomous.

Europe’s security concerns reflect its reliance on external sources for critical goods and commodities. The European Union imports over 90% of digital products and services, depends on Asia for 75%–90% of wafer fabrication capacity, and relies on China for up to 70% of key raw materials such as nickel, copper, and cobalt. Meanwhile, the BRICS+ economies control 5x the natural gas reserves of the G7, have 3x the active-duty military personnel, and double the oil reserves and uranium production. Last year, Russia boosted its defense budget by 25% to hit a new record.

In all, we believe global spending on security will be comparable to the annual investment in cloud computing and e-commerce during the 2010s. Building out semiconductors, infrastructure, and reliable, affordable power are not only pivotal levers for national security, but also for global economic competition.

We are looking for opportunities in the industrial, utilities, materials, and energy sectors. All but the industrials sector trade at a discount to the broad market. Investors don’t seem to be giving these companies much credit for future earnings growth, which we believe will be nearly double that of the market over the next few years.

In private markets, investors can find interesting prospects in smaller companies focused on innovation in technology-enabled defense systems and cybersecurity.

五、重新定义国防安全

各国政府正在重新审视国家安全策略,未来可能会投入更多资金,不仅包括传统的军事防御,还涉及网络安全、关键资源供应、能源生产、交通运输以及基础设施建设。而这背后隐藏的投资机会,市场还没有完全发掘出来。

在美国,政府似乎倾向于通过政策激励推动关键物资的本土化生产。比如,一家北卡罗来纳州的芯片制造商最近因为获得《芯片法案》7.5亿美元的资金支持,用于建设两家新的半导体工厂,其股价直接飙升了40%。同时,美国政府也在努力减少对少数传统防务巨头的依赖(目前这些公司占国防预算的90%),转而支持那些在人工智能、机器学习和5G等技术领域具有专长的商业公司和初创企业。这意味着,国防领域的市场份额和收入将不再局限于传统防务企业。

欧洲的安全问题则更加复杂。欧盟严重依赖外部供应:超过90%的数字产品和服务依靠进口,晶圆生产能力的75%-90%来自亚洲,关键原材料如镍、铜和钴有多达70%需要从中国进口。同时,金砖国家(BRICS+)在天然气储量上的控制力是七国集团(G7)的5倍,现役军人数量是G7的3倍,石油储量和铀产量更是G7的2倍。这种资源依赖使欧洲面临巨大的战略风险。

尽管如此,全球军事支出仍有很大的增长空间,尤其是在高科技武器领域。比如人机协作武器系统和完全自主的武器系统正迅速发展。仅去年,俄罗斯就将国防预算提高了25%,创下历史新高。

投资的切入点在哪里?

能源、工业、公用事业和材料行业正成为投资焦点。除了工业板块外,其他行业的估值都低于市场平均水平,我们认为这些行业未来几年的盈利增长可能会达到市场整体增速的两倍。尤其是在能源和基础设施建设领域,半导体生产能力提升、可靠能源供应的布局都至关重要。

在私募市场,小型创新企业尤其值得关注。那些专注于技术赋能的防御系统和网络安全解决方案的公司,未来可能有不小的增长潜力。

重新定义安全不只是国家战略的转变,更是未来几年里不可忽视的投资方向。如果能抓住这波机遇,可能会带来长期稳定的回报。