摩根大通资产与投资战略主席迈克尔·森巴雷斯特(Michael Cembalest)深入分析了特朗普第二任期可能给投资者带来的风险。

特朗普的第二任期政策呈现出多种典型的美国政治特征的混合体,涵盖了民族主义、反精英主义、小政府理念、保护主义以及孤立主义等元素。

森巴雷斯特指出,特朗普的“美国优先”政策可能在供给侧改革和通胀压力之间产生冲突,尤其是在当前美国股市估值较高的背景下,市场对任何政策失误的容忍度都很低。他还强调,尽管近期10年期美国国债收益率有所波动,但目前的市场状况尚不足以改变此前针对美国经济持续增长的投资策略,尤其是在新的关税政策推出相对温和的情况下。

随着特朗普政府新一轮行政命令的密集出台,投资者需要密切关注这些政策对市场的潜在影响。

下文是我对原英的精校翻译

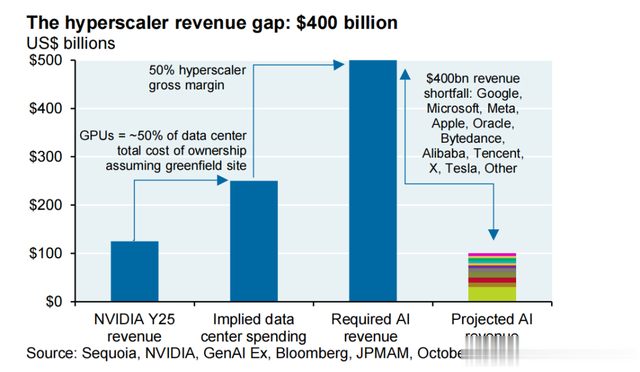

nauguruption: the flurry ofTrump 2.0executive ordersBefore getting into the eruption of executive orders released vesterday, l want to address auestions on a charfrom our 2025 Outlook which received the most attention. Our goal was to highlight rising hyperscaler capitalspending on Al infrastructure, and the general principle that these companies wil need hundreds of billions innew incremental Al revenues to maintain their current margins due to these new outlays.

特朗普政府上台后的第一天,就迅速发布了一系列行政命令。不过,在深入探讨这些政策之前,先来回答一些关于我们《2025年展望》报告中最受关注图表的疑问。这个图表的目的是强调超大规模云服务商(Hyperscalers)在AI基础设施上的资本支出正在快速增长,而这些公司要想保持当前的利润水平,必须依赖数千亿美元的新AI收入来填补这些投资缺口。

What was the inspiration for this chart?“Al's $600 billion question", a piece by David Cahn at Sequoia Capital (previously at Coatue)

Are GPUs really 50% oftotal data center costs? lhave read figures closer to 70%Estimates vary. l used a 50% GPU share as an estimate for a greenfield (new) data center based on commentsfrom jensen Huang in NVilDlA's October 2023 investor presentation, and a chart from GenAl Experts, a groupcomprised of Al professionals from Meta, Uber, Scale Al, Goldman and PwC.

Since hyperscaler capital spending is capitalized, it wouldn't immediately reduce their gross margins from anaccounting perspective, right?That is correct, the impact would show up over time via depreciation, However, these outlavs do immediatelvaffect free cash flow margins. Hyperscaler gross margins are roughly 2x their free cash flow margins, so hadused free cash flow margins as a benchmark instead, the annual revenue reguirement would have been $350bilion per year. Stil a lot more than the incremental new Al revenues that hyperscalers have been earning.

These outlays won't continue forever, right? So why be so concerned about the need to earn a perpetual $400billion in new revenues?

That's a good guestion. As far as l can tel, most analvsts covering the hyperscalers project multiple vears otelevated capital spending on Al infrastructure. One analvst referred to such outlays as "table stakes"; in otherwords, the amount of spending needed to just remain competitive. Iin addition, projections from LawrenceBerkeley Labs show data center power demand doubling from its current 4.4% of Us electricity generation, andIndependent System Operators like PjM and MlsO are scrambling to add new generation capacity based onwhat they're seeing. So, it looks like we've got at least a few more years of elevated hyperscaler spending ahead

Isn't it too soon to worry about the need for "killer app" business solutions that wil utilize all ofthis Al capacity?Isn't that inevitable based on what we have seen so far from early stage GenAl applications?The earlv-stage applications are certainly compeling. Last week, Goldman's CEO said that 95% of an s-1 filingcould be completed by Al applications in just a few minutes compared to 6 banker analysts spending two weeksdrafting documents, and there are other examples like it.

But this observation does not give us (yet) any visibilityon to the price underwriters would pay for these applications, and how these amounts compare to Al capitaoutlavs. That said, many analvsts are not worried at all about corporate uptake of Al capacity. Examples includea response to the Sequoia piece in Forbes, and another from Foundation Capital.

关于这张图表的灵感,来源于红杉资本(Sequoia Capital)合伙人David Cahn撰写的文章《AI的6000亿美元难题》。Cahn此前曾就职于Coatue,这篇文章深入分析了当前AI行业的投资现状和未来挑战。

对于数据中心成本构成,市场上存在不同的观点。有人认为,GPU的成本占比高达70%,但我们在图表中采用了50%的估算。这一数据主要依据英伟达(NVIDIA)CEO黄仁勋在2023年10月的投资者大会上的发言,以及由Meta、Uber、Scale AI、高盛和PwC等公司AI专家组成的GenAI Experts提供的研究报告。当然,具体比例可能因数据中心的类型和用途而有所不同。

虽然这些资本支出不会立刻影响企业的毛利率,因为它们会通过折旧逐步摊销,但却会直接影响企业的自由现金流(Free Cash Flow)。目前,云计算巨头的毛利率大约是自由现金流利润率的两倍。换句话说,如果以自由现金流利润率作为衡量标准,这些企业每年需要额外增加约3500亿美元的收入,以填补这些巨额投资,而目前AI业务的收入增速远远不足以支撑这样的需求。

很多人认为,这种大规模投入不会永远持续下去,但事实上,分析师普遍预计未来几年,超大规模云服务商仍将保持高额资本支出。一位业内人士甚至将这种投入形容为“入场门槛”,即如果企业想在AI市场保持竞争力,必须投入足够的资金。此外,劳伦斯伯克利国家实验室(Lawrence Berkeley Labs)的研究显示,未来几年美国数据中心的电力需求将从目前占全国电力的4.4%增长至接近翻倍,而独立电网运营商PJM和MISO也在加紧扩充电力供应,以满足AI基础设施的不断增长需求。

AI技术的早期应用已经展现了巨大的潜力。例如,高盛(Goldman Sachs)CEO曾表示,AI可以在几分钟内完成95%的上市申请文件(S-1文件)撰写,而传统方式需要6名分析师耗时两周才能完成。然而,这些应用是否能够迅速被市场接受,并创造足够的商业价值,仍然存在很大的不确定性。尽管如此,许多市场观察人士对AI的未来充满信心,认为企业最终将快速采纳这些新技术,以提升运营效率并增强竞争力。

总的来说,AI基础设施的投资仍将持续,未来几年,企业如何在技术创新与成本控制之间找到平衡,将成为关键挑战。AI行业正在经历巨大的转型期,能否真正实现商业化落地,成为所有关注该行业人士的焦点。

Trump 2.0 is a hodgepodge of distinctly American political strains: the bare-knuckled nationalism and anti-elitism of Andrew Jackson, the tariffloving protectionism of William MicKinley, the smal-government/probusiness policies of Calvin Coolidge, the unforgiving enemies lists and vendettas of Richard Nixon, thedeportation policies of Dwight Eisenhower, the manifest destiny of James Polk and the isolationism of 1914-eraWoodrow Wilson (yes, there are apparent contradictions in Trump's agenda). American First policies createrisks for investors since its supply

side benefits collide with its inflationary tendencies; there's not a lot of roomfor error at a time of elevated US equity multiples. it looks like it will be a volatile vear based on changes so farin the 10-vear Treasury, but there's not enough negative information at this time to change strategyin portfoliospositioned for continued US growth and outperformance, particularly given a more benign tariff rollout.On the next few pages, we look at the eruption of executive orders vesterday with a focus on the ones with thelargest impact on markets and the Us economy.

特朗普的第二任期政策可以说是将多种经典的美国政治传统混合在一起。他的施政方针融合了安德鲁·杰克逊式的“赤手空拳”民族主义和反精英主义,威廉·麦金莱的高关税保护主义,卡尔文·柯立芝的小政府和亲商政策,理查德·尼克松对政敌的报复心理,艾森豪威尔的驱逐移民政策,詹姆斯·波尔克的“昭昭天命”扩张理念,以及1914年伍德罗·威尔逊的孤立主义色彩。尽管这些政策看似存在矛盾,但它们共同构成了特朗普的“美国优先”战略。这种政策组合对于投资者来说既带来了机会,也增加了不确定性,因为其供给侧的优势往往会与通胀压力相冲突。在当前美股估值高企的情况下,政策上的任何失误都可能导致剧烈波动。

从目前的市场表现来看,2025年可能是充满波动的一年。美国10年期国债收益率的波动已经预示着市场的不安。然而,现阶段的经济数据并没有足够的负面信号来促使投资者改变策略,尤其是在特朗普的关税政策推进相对温和的情况下。投资者仍然倾向于维持对美国增长和市场表现的乐观预期。

图:美联储首次降息后 10 年期美国国债收益率变化

图:谁从全球化中受益?

Some notes on the Trump 2.0 hodgepodge:

Trump's manifest destiny. Trump mentioned expanding America's footprint by retaking control of thePanama Canal, making Canada the 51$* state, pursuing a purchase of Greenland from Denmark and plantingan American flag on Mars. On the Panama canal: Panama was the first Latin American country to sign upfor China's Belt & Road lnitiative.

Chinese/HK firms now operate ports at both ends of the canal, a Chinesefirm constructed a bridge across the canal and there's discussion of adjacent Chinese rail and port projectsThis casts some doubt on Panama's ability to efectively safeguard canal neutrality as agreed in the treatyNixon's enemies list compiled by Presidential Counselor Charles Colson included a total of 220 politicians,celelbrities, businessmen, reporters, labor leaders and academics. Many people on the list stated that theyconsidered being hated by Nixon as their greatest accomplishment.

You can view the original 1971 versionof the Nixon enemies list here, in the University of North Carolina archivesIMicKinley tariffs. Known as the Napoleon oftariffs, the Republican Mckinley increased the average duty onimports to almost 50%, and to 70% on imported tin plates. The subseguent increases in inflation wereoolitically disastrous: in the 1890 midterms, Republicans lost their maiority in the House with seats fallingfrom 171 to 88. and after the 1892 election, all branches of government were under Democratic contro

特朗普2.0政策大杂烩的一些要点

1. 特朗普的“昭昭天命”扩张计划

特朗普曾公开提及,要扩大美国的国际影响力,包括重新控制巴拿马运河,让加拿大成为美国的“第51个州”,试图从丹麦购买格陵兰岛,甚至计划在火星上插上美国国旗。巴拿马运河在地缘政治上的重要性不言而喻,目前中国已在运河两端的港口运营,修建了一座横跨运河的大桥,并计划在周边建设铁路和港口设施。这些举措引发了对巴拿马能否继续保持运河中立性的担忧。

2. 尼克松式的“黑名单”

尼克松时期,白宫顾问查尔斯·科尔森整理了一份包含220名政界人士、名人、商界领袖、记者、工会领袖和学者的“敌人名单”。许多人甚至认为,能上这份名单是自己的一种成就。特朗普的做法是否会重演类似的政治清算,仍是市场关注的焦点。

3. 麦金莱式关税保护主义

特朗普对关税政策的偏好可与19世纪末的麦金莱相提并论。当时,麦金莱政府将进口商品的平均关税提高到近50%,而锡板等产品的税率更是达到了70%。结果,这些政策导致通胀飙升,最终在1890年中期选举中,共和党在众议院的席位大幅下滑。历史经验表明,过度的保护主义可能会带来短期收益,但长期来看,经济和政治成本可能更高。

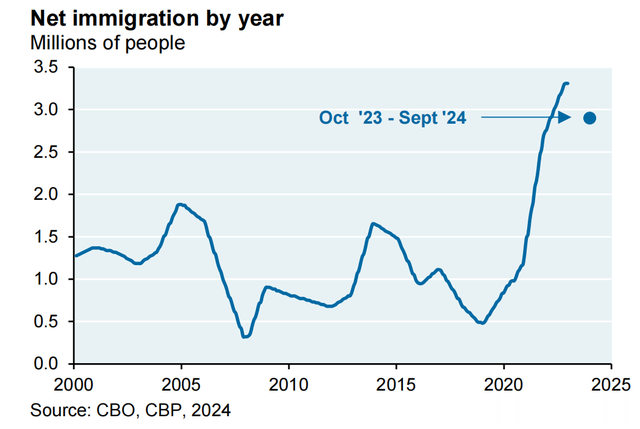

Immigration. Trump deportation policies might seem extremel and costly’, causing think tanks like thePeterson Institute to write about potential drags on gowth and employment3. But like Newton's Third Law ofMotion, sometimes every political action has an equalind opposite reaction. The Biden administration oversaw,resulting in soaring unresolved immigration cases, anthe largest uncontrolled immigration surge on recoress at the border. The Trump deportation policies are aerosion in municipal solvency and scenes of lawlessni

reaction to that, and possibly temporary4

US labor markets may start tightening again: the JOlTS job opening rate is rising, the S&P Human ResourcesIndex is rallying and small business optimism/capex pans are rising. Should labor supplies tighten excessively.the Administration would have the tools at its disposalto relaximmigration restrictions.

And remember:Trumpration, which could be increased as necessary.stated again last night that he's in favor of legal immigThe proposed end of birthright citizenship is the mostcontroversial of Trump'simmigration-related executivean interpretation of the 14th Amendment's Citizenshiporders. The order directs federal agencies to adoptClause that conflicts with the past century of practiceloased on a 1898 Supreme Court case. lt takes effect forost certainly be one of the first Executive Orders to makechildren born at least 30 days from now. This will almits way to the Supreme Court; it's unlikely in my view thlat a Court majority would accept Trump's interpretation.

4. 强硬的移民政策

特朗普的移民政策一直饱受争议,包括大规模遣返移民的计划,这一政策可能会带来较高的执行成本,甚至拖累经济增长。皮特森国际经济研究所(PIIE)等智库指出,大规模驱逐移民可能会对劳动力市场和整体经济增长产生负面影响。然而,从政治角度来看,特朗普此举是对拜登政府移民政策的反弹,毕竟过去几年美国经历了创纪录的非法移民潮,导致各州财政紧张,边境地区治安问题加剧。

尽管特朗普的移民政策目前显得强硬,但他本人也表示,支持“合法移民”,未来可能根据劳动力市场情况灵活调整。近期美国的职位空缺率上升,标普人力资源指数回暖,小企业信心和资本开支计划均呈现上升趋势。这表明,如果劳动力市场持续收紧,特朗普政府可能会放宽移民政策,以缓解用工压力。

5. 取消出生公民权的争议

特朗普签署的行政命令中,最具争议的一项是试图终结“出生公民权”。该命令要求联邦机构对《第十四修正案》的“公民身份条款”做出新的解释,而这一政策已经实施了一个多世纪。根据新的规定,30天后在美国出生的婴儿将不再自动获得公民身份。这一政策预计将很快进入最高法院审理,外界普遍认为法院不会轻易支持特朗普的立场。

投资市场的影响与应对

特朗普的关税政策可能会导致部分产业受益,如本土制造业和能源行业,但同时也会推高通胀,增加企业成本。对市场而言,贸易政策的不确定性仍是未来一段时间的主要风险点。全球供应链需要重新调整,而企业需要做好应对关税调整和劳动力市场变化的准备。

此外,特朗普政府对外政策的调整,可能对美元走势、资本流动以及企业投资决策产生深远影响。投资者需要密切关注政策走向,灵活调整投资组合,抓住可能出现的市场机会。

特朗普2.0政策将继续围绕“美国优先”的理念展开,无论是移民、关税还是国际事务,都将对全球经济格局产生深远影响。未来的市场走势,仍需紧盯政策动向,灵活应对可能出现的各种挑战。

图:美国非法移民涌入情况

每季度,数百万非法移民进入美国。

图:移民和海关执法局(ICE)按总统执政期间的遣返数据

按月统计的遣返与返回人数。

图:历年净移民流入情况

单位:百万

图:未决移民案件

案件数量(百万)

According to Vice President Vance, the Trump Administration plans to deport roughly 1milion undocumentecworkers per vear, The current number of undocumented workers in the US is estimated at 11.7 milionThe lmmigration Council estimates that a deportation program could cost $88 bilion per year to implementDeportation impact: PllE estimates a real GDp decline of 1.2%-7.4% by 2028, and similar declines in employmentIn 1954 under Eisenhower, annual deportations peaked at 1.1 million according to DHS data, a figure whichincluded both documented and undocumented workers. just two years later, deportations fell by over 9o% tojust 80,000 as funding and support for the deportation program evaporated

According to Vice President Vance, the Trump Administration plans to deport roughly 1milion undocumentecworkers per vear, The current number of undocumented workers in the US is estimated at 11.7 milionThe lmmigration Council estimates that a deportation program could cost $88 bilion per year to implementDeportation impact: PllE estimates a real GDp decline of 1.2%-7.4% by 2028, and similar declines in employmentIn 1954 under Eisenhower, annual deportations peaked at 1.1 million according to DHS data, a figure whichincluded both documented and undocumented workers. just two years later, deportations fell by over 9o% tojust 80,000 as funding and support for the deportation program evaporated1. 根据副总统万斯(Vance)的说法,特朗普政府计划每年遣返约100万名非法移民。当前,美国非法移民总人数约为1170万人。

2. 美国移民委员会估算,实施全面遣返计划每年将耗资880亿美元。

3. 彼得森国际经济研究所(PIIE)预测,若执行大规模遣返,美国的实际GDP可能在2028年下降1.2%至7.4%,就业率也将出现类似降幅。

4. 1954年艾森豪威尔政府时期,美国年度遣返人数曾达到110万的峰值,但两年后,由于经费及政策支持减少,遣返人数锐减90%,仅为8万。

Energy and related infrastructure: read the fine print. You can try to streamline permits for pipelines andtransmission projects with executive orders, but without explicit Federal eminent domain legislation, projectscan still be challenged for a number of reasons. As shown below, oil pipeline, gas pipeline and transmission lineprojects in the US have practically ground to a halt.

lt would be quite a feat from a political perspective to jumpstart the pace. The Trump agenda also cals for an "end to leasing to wind farms", but only 2% of US wind powertakes place on public lands as opposed to private lands, so that's a marginal issue at best.Trump's executive orders also paused distribution of undisbursed loan and grant monies from the infrastructureand energy bills (specifically mentioning EV charging stations as area for pausing disbursements) until Agenciescome up with new energy projects consistent with Trump America First objectives.

This would not count asimpoundment as far as we can tell given the broad spending discretion defined in the original bills. These ordersexplain why in mid-anuary, Biden rushed through a $6.5 bilion loan to Rivian and a $1.7 loan guarantee to PlugPower for a hydrogen project (insert face-palm emoji here).

Trump also refers to terminating the "electric vehicle mandate". My interpretation: Trump is referring to Bidenrules announced in March 2024 that reduce allowable fleet-level GHG emissions by cars and trucks by ~50% by2032. Such rule changes could slow auto industry development of EV models, but the larger driver of Evadoption is probably the $7,500 EV subsidy included in Biden's energy bill. As far as l can tel, Trump cannotunilaterally rescind the EV subsidy as it was part of prior legislation (the humorously named "Inflation ReductionAct"). EVs were less than 3% of the Us passenger car fleet by the end of 2024, so l don't see this as a hugeeconomic driver just vet. The biggest possible casualty: all those EV battery assembly plants that are being builin red states from Georgia to Michigan.

能源与相关基础设施:细节决定成败

特朗普政府试图通过行政命令简化管道和输电项目的审批流程,但如果缺乏联邦征地法案的明确支持,这些项目仍可能因法律问题而停滞不前。数据显示,美国的石油、天然气管道及输电线路建设几乎陷入停滞,如何重启这些项目将成为政治上的一大挑战。

特朗普还计划终止“风电场租赁”政策,但影响可能有限,因为美国只有2%的风力发电位于联邦公共土地,其余大部分都在私人土地上。因此,该政策调整的实际影响微乎其微。

同时,特朗普的行政命令暂停了尚未拨付的基础设施和能源项目资金,尤其是涉及电动车充电站的项目,要求各相关机构制定新的“美国优先”政策后才能继续拨款。这也解释了为何拜登政府在1月中旬紧急批准了65亿美元的Rivian电动车贷款及17亿美元的Plug Power氢能项目贷款担保,以防资金被冻结。

特朗普或终止电动车相关政策

特朗普提到要“终止电动车强制推广政策”,这一表态主要针对拜登政府于2024年3月发布的汽车排放法规。根据新规,美国汽车制造商必须在2032年前将车队温室气体排放量削减约50%。如果特朗普废除该法规,可能会减缓汽车制造商在电动车领域的投资步伐。

然而,电动车行业的最大驱动力来自于拜登政府法案中的7500美元购车补贴。根据现有法律,特朗普无法单方面取消该政策,因为补贴已包含在《通胀削减法案》中。截至2024年底,电动车(包括纯电动车和插电式混合动力车)仅占美国乘用车总量的3%,短期内不会对整体经济造成太大影响。

如果特朗普的政策推行,受到最大影响的可能是正在共和党执政州(如佐治亚州、密歇根州等)建设的电动车电池工厂,这些项目可能面临政策变动的不确定性。

图:年度液体燃料管道建设项目数量:近年来,项目数量大幅减少。

图:天然气管道新增输送能力(每日输气量,单位:十亿立方英尺):2024年增幅低于预期。

图:输电线路建设(新增里程,单位:英里):增长停滞,输电瓶颈问题凸显。

图:电动车市场份额(包括纯电动车与插电式混动车,占比):截至2024年底,电动车在美国乘用车市场的占比不足3%,增长仍处于初级阶段。

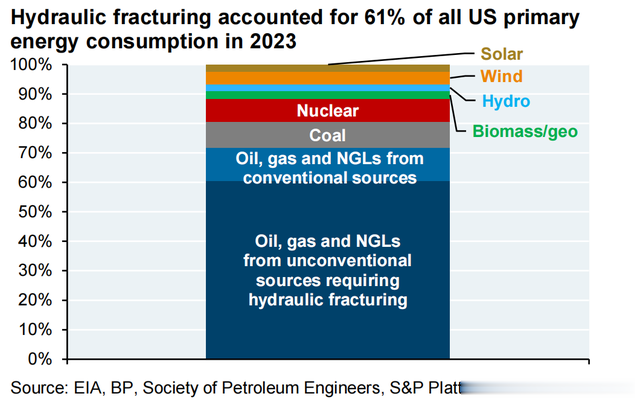

Trump might have more luck achieving Bessent's target for higher domestic energy production. Based on oulenergy math, Bessent's 3-3-3 target amounts to a 7% increase in oil, gas and NGL production (most of which wicontinue to rely on hydraulic fracturing) and is a very achievable goal. Whether this brings down Us energyprices is less clear, That depends on how much of the new production is exported, and the degree to whichstates continue to disconnect coal, gas and nuclear power in favor of renewables and energy storage. As showrbelow, inflation in consumer and industrial electricity supply chains is deeply entrenched at this point

特朗普或许更有可能实现贝森特提出的“3-3-3”能源生产目标。根据我们的能源测算,该目标意味着美国石油、天然气和天然气液(NGL)产量需增长7%,这一增幅主要依赖水力压裂技术,整体来看是相对可行的。然而,能否因此降低美国的能源价格,仍存在很大的不确定性。这主要取决于新增产量的出口比例,以及各州是否继续逐步淘汰燃煤、天然气和核能发电,转而增加可再生能源和储能设施的比例。数据显示,目前美国居民和工业用电的供应链通胀问题依然严重,短期内难以缓解。

图:原油、天然气及天然气液产量(单位:万亿英热单位/月)

图:2023年,美国61%的主要能源消费来自水力压裂技术

图:各州居民电价(单位:美分/千瓦时)

图:核心商品生产者价格指数(PPI),47类核心商品相较2018年的通胀增长幅度(%)

International taxation. | was glad to read this partof the America First manifesto if it means what l think itmeans: “America will no longer be beholden to foreisn organizations for our national tax policy, which punishesAmerican businesses". In November 2023',|wroteabout the Pillar ll tax system that Europe was attemptingtime: “pillar ll provisions are essentially bounty-huntingto impose on the US.

This was my conclusion at thethe tax policy of other countries and collect tax revenuerules that allow a third-party country to intervene iithat it has no legal nexus with. By allowing non-UScountries to collect taxes from US companies on incomex policy and hamstrings Congress' ability to design policyearned in the US, Pillar ll arguably undermines US tabased on US needs". The Biden Administration sup!orted Pillar ll and proposed changes to bring US corporateTreaty by the Senate or via Congressional legislation. Sotax law closer to it, but tax policy can only be set viàfar, Pillar ll rules have not been adopted by the Usand neither have Pillar | rules on Digital Service Taxesanother thinly veiled European attempt to impose pienalties on USs tech giants.

"Drain the Swamp/DOGE" executive orders include a hiring freeze, a pause in regulations not yet in effectrescinding Biden-era executive orders, returning the federal workforce to the office, etc. As we explained in the2025 Outlook, Federal employment of 3 mm people is at its lowest level as a share of US employment in 85years (~2%). Within Federal workers, the largest employer is the Dep't of Defense (excluding active militaryfolowed by the Postal Service and Veterans Affairs, As for agencies in the DOGE crosshairs: the EnvironmentaProtection Agency, Securities and Exchange Commission and Department of Labor when combined account foless than 1% of federal workers, while the Department of Education accounts for just 0.14%. So, it's not clearthat DOGE will be able to move the needle on government spending here.

Having lost his Sancho Panza (Vivek Ramaswamy is reportedly going to run for Governor of Ohio), DOGE Quixote(Elon Musk) will need to proceed on his own in his guest to reduce government spending. Repealing the BiderExecutive Actions shown below would save around $100 bilion per year, which is a small step towards the largelgoals that DOGE has established for itself. Where might DOGE have to look after repealing Biden ExecutiveActions; entitlement spending and defense spending", which are much larger drivers of sky-rocketing Us debtlevels than non-defense discretionary spending or the size of Federal government Agencies.

国际税收政策的调整

我对“美国优先”宣言中关于国际税收政策的内容感到高兴,这是否意味着美国将不再受制于外国组织的税收规定,从而保护本国企业不受不公平待遇。早在2023年11月,我曾撰文批评欧洲试图向美国施加“第二支柱税收制度”(Pillar II)的影响。当时我的观点是:“第二支柱税收制度本质上是一种‘赏金猎人’规则,允许第三方国家干涉其他国家的税收政策,收取与其毫无法律关联的税收收入。该制度允许非美国国家对美国公司在本土产生的收入征税,这无疑破坏了美国税收政策的独立性,并限制了国会根据本国需求制定政策的能力。”

拜登政府曾支持Pillar II,并提议调整美国企业税法,使其与该制度接轨。然而,美国税收政策的制定只能通过参议院批准的条约或国会立法执行。截至目前,美国尚未采纳Pillar II规则,也未接受Pillar I关于数字服务税(DST)的要求,这被广泛视为欧洲针对美国科技巨头的又一次“隐形惩罚”。

“抽干沼泽/DOGE”行政命令

特朗普政府最新发布的“抽干沼泽”(Drain the Swamp)行政命令包括冻结联邦政府招聘、暂停尚未生效的法规、撤销拜登时期的行政命令,并要求联邦雇员返回办公室办公等措施。根据我们在《2025年展望》报告中的分析,当前美国联邦政府雇员人数占全国就业人口的比重已降至85年来的最低水平,仅为2%左右。

在联邦雇员构成中,国防部(不包括现役军人)是最大雇主,其次是邮政局和退伍军人事务部。而被“DOGE”政策针对的主要政府机构包括环境保护署(EPA)、证券交易委员会(SEC)和劳工部(DOL),但这三者合计仅占联邦雇员总数的不到1%。教育部所占比例更小,仅为0.14%。因此,是否能通过裁员来显著削减政府支出,仍存在很大疑问。

图:联邦雇员占总就业人数的比例—2023年联邦雇员构成细分

DOGE如何削减政府支出

特朗普的“DOGE”计划在失去昔日的“桑丘·潘沙”——维韦克·拉马斯瓦米(Vivek Ramaswamy,传闻将竞选俄亥俄州州长)后,将不得不独自推进削减政府支出的行动。据估算,若能撤销拜登政府时期的行政命令,每年可节省约1000亿美元。

然而,仅靠撤销拜登政策远远不够,要实现更大规模的财政目标,“DOGE”可能需要将目光投向更为庞大的联邦支出领域,例如社保福利和国防预算。这些支出增长速度远超非国防类自由裁量支出,也远超政府机构的运营开支。

撤销拜登政府行政命令所带来的节省(单位:十亿美元):社保和国防预算的削减可能将是特朗普政府未来财政调整的重点。

The biggest executive order surprise: the slow rollout of tariffs. Trump stated last night that 25% tariffs couldbe imposed on Mexico and Canada beginning on Felruary 1 since they're “allowing a vast number of peopleof explicit tariffs on China or a universal tariff. Trump alsoover the border", but there were few mentions (yet)first term but they were never implemented.

Trump didthreatened 25% tariffs on Mexico and Canada in hissign an executive order directing federal agencies toexamine unfair trade and currency practices and to assesswhether foreign governments have complied with telms of existing trade deals.I still expect Trump to increase tariffs on China and'n EU auto imports as well. lf there is a universal tariff, lexpect it would only apply to critical imports which are 10%-20% of all US imports. As a reminder, most macro-economists who study tariffs believe that they woulreduce US manufacturing employment. lf they're right,the impact could well be felt in red states more thann blue ones (8 of the top ten import/GDP states are red)

While most economists believe tariffs are unlikely to restore Us most manufacturing jobs lost to globalizationsee chart, upper right, let's go back to Newton's Third Law of Mlotion and reactions/opposite reactions again.As shown below, the US allowed the international trade system to get to the point where most countries hachigher tariffs on the Us than the Us had in exchange. By 2015, almost every country was below the "tarifreciprocity line". Had the US not gotten to this point, and had Us industrial production not stagnated sinceChina's entry into the WTO, we might not be talking about tariffs today. Like deportations, should tariffs proveto be the minefield that economists expect them to be, they can always be adjusted and/or repealed.

nent that 10 existing rules be eliminated for any new ruleLastly, on deregulation. Trump mentioned a requirelt Trump applied in his first term. But here comes the fineto be enacted. This follows on the 2-to-1 standard thaprint again: it's hard to dismantle the regulatory state.

As explained below, the notice-and-comment rulemakingprocess could take 6 to 12 months, and sometimeshe Courts side with those challenging new rules (or therescinding ofexisting rules). During Trump's first tern,out of 77 major rules that were challenged, Trump wonjust 31% of the time, experienced a mixed outcome12% of cases and lost the rest of the time?. But even iftill probably dampen the regulatory juggernaut, as similarthe 10-to-1 standard doesn't work as planned, it will spolicies did during Trump's first term. One thing'sfor sure: our CEO clients generally believe that the USvdown in the breakneck pace of regulation.economy would benefit from at least a temporary slo!

The notice-and-comment rulemaking process for changing and rescinding federal regulations could takea minimum of six to twelve months. A new President cannot simply direct agencies to immediatelyadopt new regulations or repeal existing ones. The Administrative Procedure Act generally requiresagencies to provide public notice about new regulations and changes to existing regulations they'reconsidering. Agencies also must make the evidence, research and analysis supporting their proposedchanges publicly available.

The public is then given an opportunity to respond, raise concerns, present additional research orevidence and suggest alternatives. The agency proposing the change is reguired to review thosesubmissions and either adjust its proposal or explain why it rejects the suggestions. lf an agency fails toprovide a sufficiently reasoned response, a court may invalidate the regulation as "arbitrary andcapricious" and remand the matter back to the agency for further consideration.

The Administration mayseek to avoid delays by claiming that changes need to be adopted immediately, on an emergency basisbut courts would carefully scrutinize such claims.The Supreme Court's recent elimination of the Chevron doctrine presents another potential hurdle forthe new administration. For the past four decades, courts generally gave substantial deference to agencyinterpretations of many statutory provisions. With the elimination of Chevron deference, agencies wiloften now be reguired to show that their proposals are not only supported by the administrative recordbut also the best interpretation of the underlying statutory provisions.

特朗普最新的行政命令中,最让人意外的莫过于对关税的“缓慢推进”。他昨晚表示,可能从2月1日起对墨西哥和加拿大进口商品加征25%关税,理由是这两个国家“允许大量非法移民进入美国”。不过,目前尚未提及对中国或其他国家实施普遍关税的具体计划。值得注意的是,特朗普在第一任期时也曾威胁对墨西哥和加拿大征收同样的关税,但最终并未实施。

与此同时,特朗普签署了一项行政命令,要求联邦机构对不公平的贸易和货币政策进行审查,并评估外国政府是否遵守现有贸易协议的相关条款。我仍然预计,特朗普将会提高对中国以及欧盟汽车的进口关税。如果最终决定实施普遍关税,可能仅会针对关键进口产品,这些产品约占美国总进口额的10%-20%。

图:经济学家对特朗普关税政策的看法

根据对44位经济学家的调查,大多数人认为关税不太可能帮助恢复因全球化而流失的制造业岗位。事实上,这些措施可能会对美国的制造业就业产生负面影响,尤其是在“红州”(共和党占优势的州),因为美国十大进口依赖GDP最高的州中,有8个是红州。

图:全球制造业向新兴市场转移的趋势

尽管许多经济学家认为,关税难以真正让制造业回流美国,但如果回顾过去,美国的贸易政策显然对这一问题有所忽视。数据显示,到2015年,几乎所有国家对美国的关税都高于美国对其的关税,美国在贸易政策上处于劣势。若当年能更早采取措施,且中国加入WTO后美国的工业生产未陷入停滞,或许今天就不会讨论关税问题了。与移民政策类似,如果关税政策成为经济发展的绊脚石,特朗普政府完全可以调整甚至撤销这些措施。

放缓监管步伐:特朗普的改革难题

特朗普在讲话中提出,每制定一项新法规,必须废除10项现行法规。这一做法与他第一任期时的“2比1”法规标准类似。但现实情况是,想要削减现有监管体系并不容易。根据规定,废除或修改联邦法规通常需要6至12个月的公告和意见征求期,而在此期间,法院可能会受理对新规的质疑,进而拖延实施进度。

数据显示,在特朗普第一任期,77项主要监管法规中,政府仅赢得了31%的诉讼,而12%的案件结果呈现混合,剩余案件均以失败告终。因此,即使新的“10比1”标准未能全面落实,依然可能会对监管扩张产生一定的抑制作用,就像第一任期的情况一样。许多企业高管普遍认为,美国经济需要放慢监管步伐,至少在短期内能给企业更多喘息的空间。

联邦法规变更的复杂流程

根据《行政程序法》,政府机构在推出新规或废除旧规时,必须向公众提供通知,公开其相关研究与分析,并征求意见。公众可以提供反馈或提出替代方案,若政府未能合理回应,法院可能会判定该法规“武断且不合理”,并将其驳回。因此,新政府无法立即通过行政命令对法规进行大幅度调整,而必须经过严格的法律程序。

最高法院对监管的制约

最高法院近期废除了“雪佛龙原则”(Chevron Deference),该原则曾给予联邦机构对法规条款较大的解释权。如今,行政机构必须提供更充分的法律依据,证明其新规不仅符合行政记录,还要成为对现行法律的最佳解释。这一变化将使新政府更难快速推进其监管改革议程。